Opening a business bank account is a crucial step for any enterprise, separating personal and business finances, simplifying accounting, and establishing professional credibility. This process requires specific documentation to verify the business’s legitimacy and the owner’s identity. Understanding these requirements beforehand streamlines the application process and minimizes potential delays.

Business Identification Documents

These documents legally establish the business’s existence and structure.

Proof of Business Address

Verification of the business’s physical location is essential.

Ownership Documentation

Documents identifying the business owners and their authority are required.

Business Licenses and Permits

Depending on the industry and location, specific licenses and permits might be necessary.

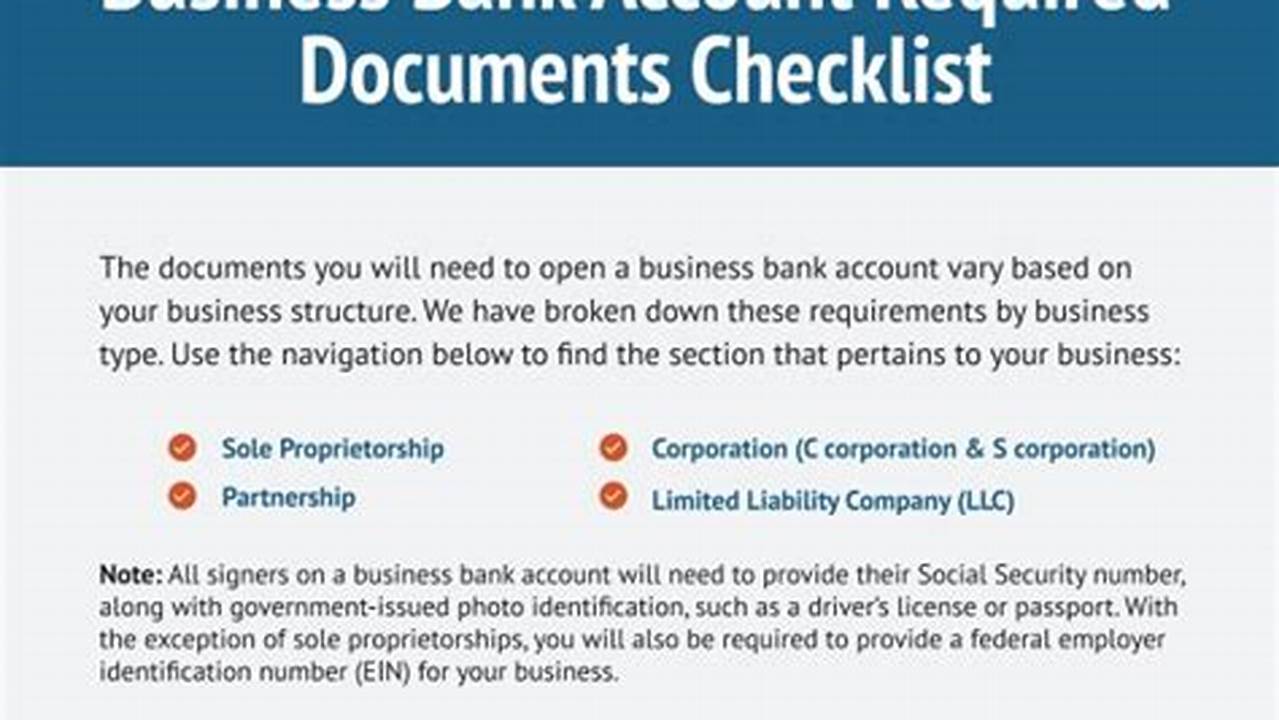

Employer Identification Number (EIN)

For certain business structures, an EIN issued by the IRS is mandatory.

Formation Documents

Documents like Articles of Incorporation or Partnership Agreements define the business’s legal structure.

Operating Agreement

For LLCs, an operating agreement outlines member responsibilities and ownership structure.

Personal Identification of Authorized Signers

Government-issued identification verifying individuals authorized to access the account is required.

Tips for a Smooth Application Process

Gather Documents in Advance: Compiling necessary documents beforehand saves time and prevents delays.

Check Bank-Specific Requirements: Different banks may have specific documentation requirements; confirming these beforehand is advisable.

Ensure Documents are Current: Expired documents are typically not accepted; ensure all documents are up-to-date.

Maintain Organized Records: Keeping clear and organized records of all business documents simplifies the process.

Frequently Asked Questions

What if my business is home-based? Banks typically accept utility bills or official government correspondence as proof of address for home-based businesses.

Do I need an EIN if I am a sole proprietor? While not always required for sole proprietorships without employees, obtaining an EIN can simplify certain business processes.

Can I open a business bank account online? Many banks offer online applications for business accounts, streamlining the process.

What if I am a foreign business owner? Banks may require additional documentation for foreign business owners, such as visas or immigration paperwork.

How long does it take to open a business bank account? The account opening process timeframe varies depending on the bank and the completeness of the submitted documentation.

What are the benefits of having a separate business bank account? Separating business and personal finances simplifies accounting, protects personal assets, and presents a more professional image.

By understanding and preparing the necessary documentation, businesses can efficiently open a bank account, laying a solid foundation for financial management and growth.