Terminating a banking relationship can seem complex, but with proper preparation and resources, it can be a smooth process. Understanding the necessary steps, having a well-crafted letter, and access to a reliable guide are key to efficiently and effectively closing an account.

Understanding Account Closure

Before initiating the process, it’s essential to gather all relevant information and understand any potential fees or requirements.

Gathering Necessary Documents

Having the correct identification, account numbers, and any other requested documentation will expedite the closure.

Clearing Outstanding Transactions

Ensure all pending transactions, including checks and automatic payments, are processed or canceled before closing the account.

Setting Up Alternative Banking Arrangements

If necessary, establish a new account elsewhere to handle future transactions and direct deposits.

Notifying Relevant Parties

Inform any individuals or organizations that regularly deposit or withdraw funds from the account about the closure.

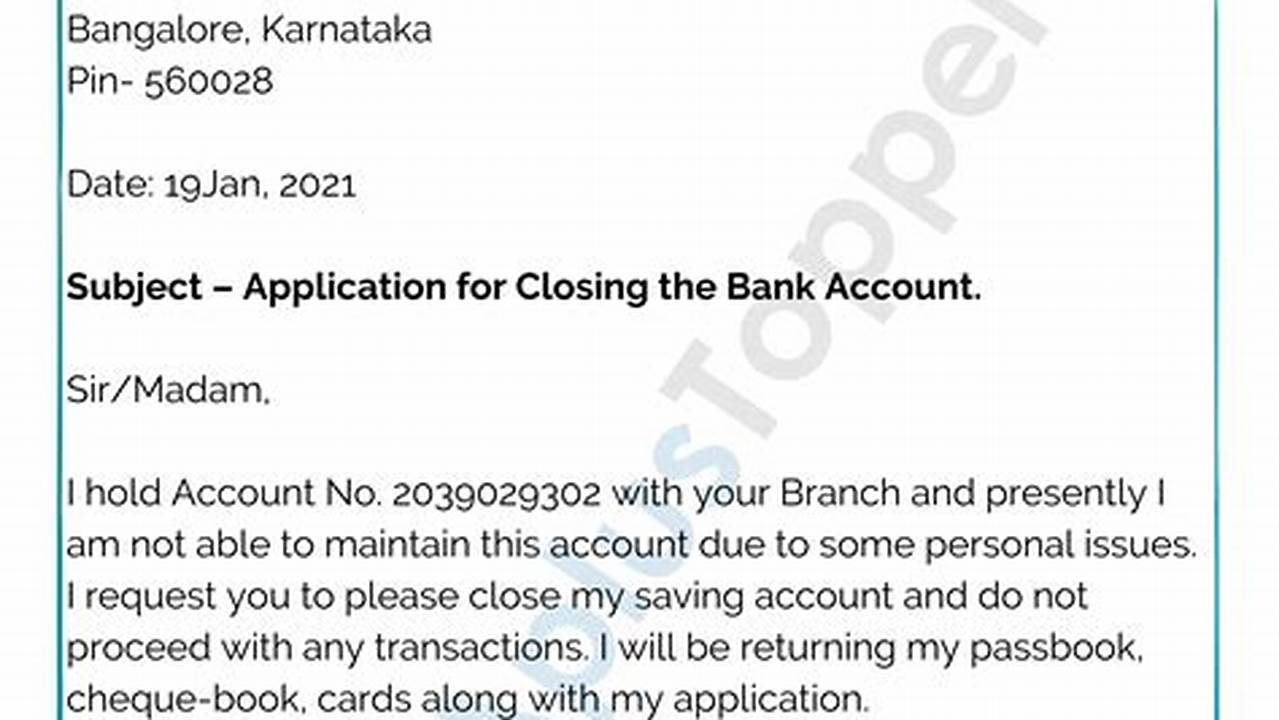

Drafting a Formal Closure Request

A well-written letter clearly stating the intent to close the account and providing necessary details is crucial.

Reviewing Terms and Conditions

Understanding the bank’s specific procedures and any associated fees is important before proceeding.

Confirming Closure

After submitting the request, follow up with the bank to confirm the account has been closed and obtain written confirmation.

Tips for a Smooth Closure

Tip 1: Maintain Sufficient Funds. Ensure enough funds remain in the account to cover any outstanding transactions or fees.

Tip 2: Update Automatic Payments. Redirect automatic payments and deposits to a new account to avoid disruptions.

Tip 3: Retain Records. Keep copies of all closure documentation, including the closure letter and confirmation from the bank.

Tip 4: Verify Account Balance. Check the final account balance to ensure all transactions are reconciled.

Frequently Asked Questions

Can I close my account online?

This depends on the bank’s policies. Some banks allow online closure, while others require in-person or written requests.

What happens to any remaining funds?

Typically, the bank will issue a check for the remaining balance. Some banks may offer to transfer the funds to another account.

How long does it take to close an account?

The timeframe varies depending on the bank and the complexity of the account. It can range from a few days to a couple of weeks.

Are there any fees associated with closing an account?

Some banks may charge fees for closing an account, especially if it’s closed within a certain timeframe of opening. Review the account terms and conditions.

What if I have a joint account?

Both account holders typically need to agree to and sign the closure request.

What if I lose my account closure confirmation?

Contact the bank and request a new copy of the closure confirmation.

By following these guidelines and preparing adequately, individuals can navigate the account closure process efficiently and minimize potential complications. A well-structured approach ensures a seamless transition and peace of mind.