Maximizing your financial growth requires strategic placement of your funds. Selecting a savings account with a competitive interest rate is a fundamental step towards achieving this goal. Higher interest rates translate to greater returns on your deposits, accelerating the growth of your savings over time. This approach allows your money to work harder for you, passively generating income while remaining easily accessible.

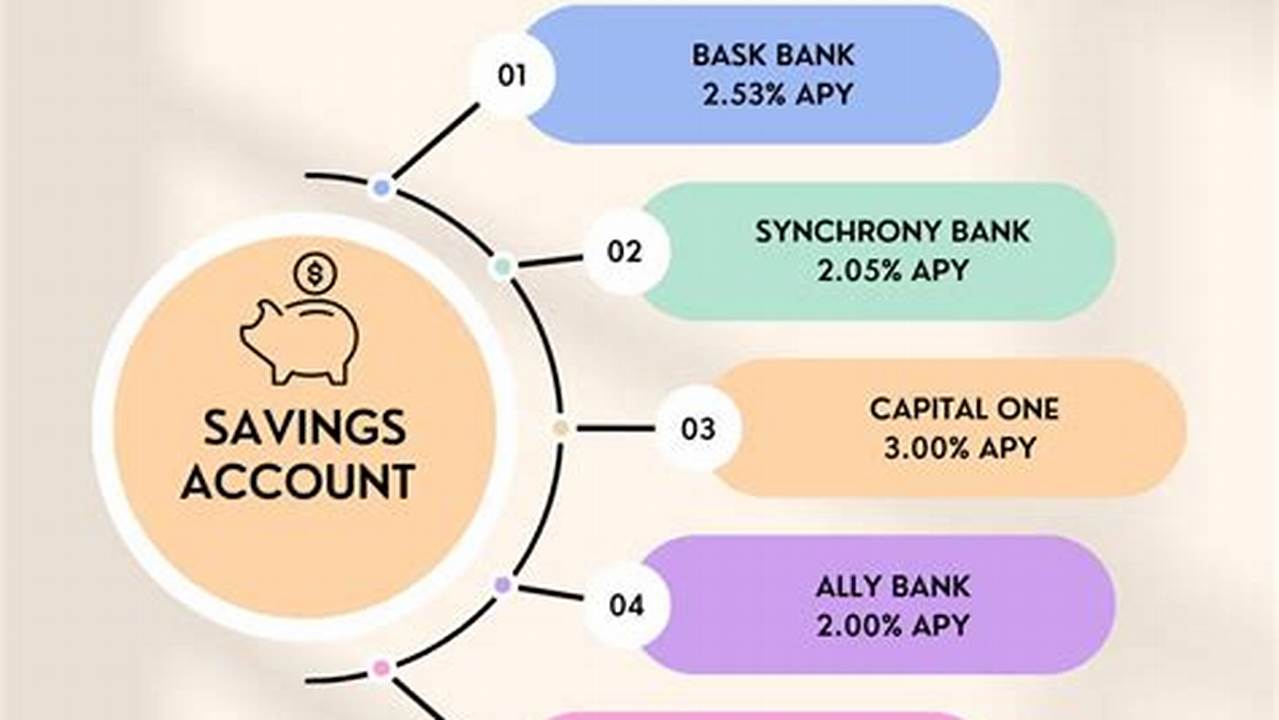

Interest Rate Comparison

Evaluate various financial institutions and compare their advertised annual percentage yields (APYs). Don’t settle for the first offer you encounter.

Account Fees and Minimums

Scrutinize account terms for potential fees, including monthly maintenance charges, overdraft penalties, and transfer limitations. Consider minimum balance requirements and their impact on your accessibility to funds.

Online vs. Traditional Banks

Explore both online banking platforms and traditional brick-and-mortar institutions. Online banks often offer higher interest rates due to lower overhead costs.

Compounding Frequency

The frequency of interest compounding (e.g., daily, monthly, quarterly) significantly affects your returns. More frequent compounding leads to faster growth.

Account Features and Accessibility

Assess the availability of features such as online banking, mobile check deposits, ATM access, and customer service responsiveness.

FDIC Insurance

Ensure your chosen institution is insured by the Federal Deposit Insurance Corporation (FDIC) in the US or equivalent deposit insurance in other countries. This protects your deposits up to a specified limit.

Promotional Offers

Be aware of temporary promotional interest rates or bonus offers. Understand their terms and duration to avoid unexpected rate changes.

Long-Term Financial Goals

Align your choice of savings account with your overall financial goals. Consider whether the account supports your short-term and long-term saving strategies.

Tips for Choosing the Right Account

Tip 1: Regularly review interest rates as they can fluctuate based on market conditions.

Tip 2: Set up automatic transfers to consistently contribute to your savings.

Tip 3: Diversify your savings across different accounts or investment vehicles.

Tip 4: Consult with a financial advisor to discuss your specific financial needs and goals.

Frequently Asked Questions

How often do interest rates change?

Interest rates can change frequently, sometimes daily, in response to market dynamics and economic conditions.

What is the difference between APY and interest rate?

The annual percentage yield (APY) reflects the total amount of interest earned in a year, including the effects of compounding, while the interest rate is the basic rate before compounding is considered.

Are online savings accounts safe?

Reputable online banks with FDIC insurance offer the same level of security as traditional banks.

Can I have multiple savings accounts?

Yes, you can open and maintain multiple savings accounts at different institutions to take advantage of various interest rates and features.

How can I maximize my savings growth?

Combining high-yield savings accounts with other investment strategies can help maximize your overall financial growth.

What documents do I need to open a savings account?

Generally, you will need identification, proof of address, and a social security number or equivalent.

Choosing a savings account with a competitive interest rate is a crucial step towards effective financial management. By diligently researching and comparing available options, individuals can harness the power of compound interest and pave the way for a more secure financial future.