Accessing formal financial services is crucial for economic participation and security. Traditional banking often requires identification, raising questions about accessibility for those lacking standard forms of ID. This exploration examines the possibilities and challenges of establishing a bank account without traditional identification.

Why is Access to Banking Important?

Financial inclusion empowers individuals to manage finances effectively, save securely, and access credit. It promotes economic stability and growth, both individually and within communities.

Challenges of Traditional ID Requirements

Traditional ID requirements can exclude vulnerable populations, such as the homeless, refugees, or those in remote areas without access to documentation.

Alternative Identification Methods

Some institutions explore alternative methods, such as biometric data, utility bills, or community vouching systems, to verify identity and facilitate account opening.

Regulations and Compliance

Banks must comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which necessitate identity verification to prevent illicit activities.

Financial Inclusion Initiatives

Global initiatives aim to expand financial inclusion by developing innovative identification solutions and promoting accessible banking services.

The Role of Technology

Technological advancements, like digital identity platforms, can streamline verification processes and expand access to financial services.

Risks and Considerations

Implementing alternative identification methods requires careful consideration of security risks and potential fraud vulnerabilities.

Benefits of Expanding Access

Increased access to banking can reduce reliance on informal financial systems, empowering individuals and fostering economic growth.

Future of Identification in Banking

The future likely involves a combination of traditional and innovative identification methods to balance security and accessibility.

Tips for Navigating the Process

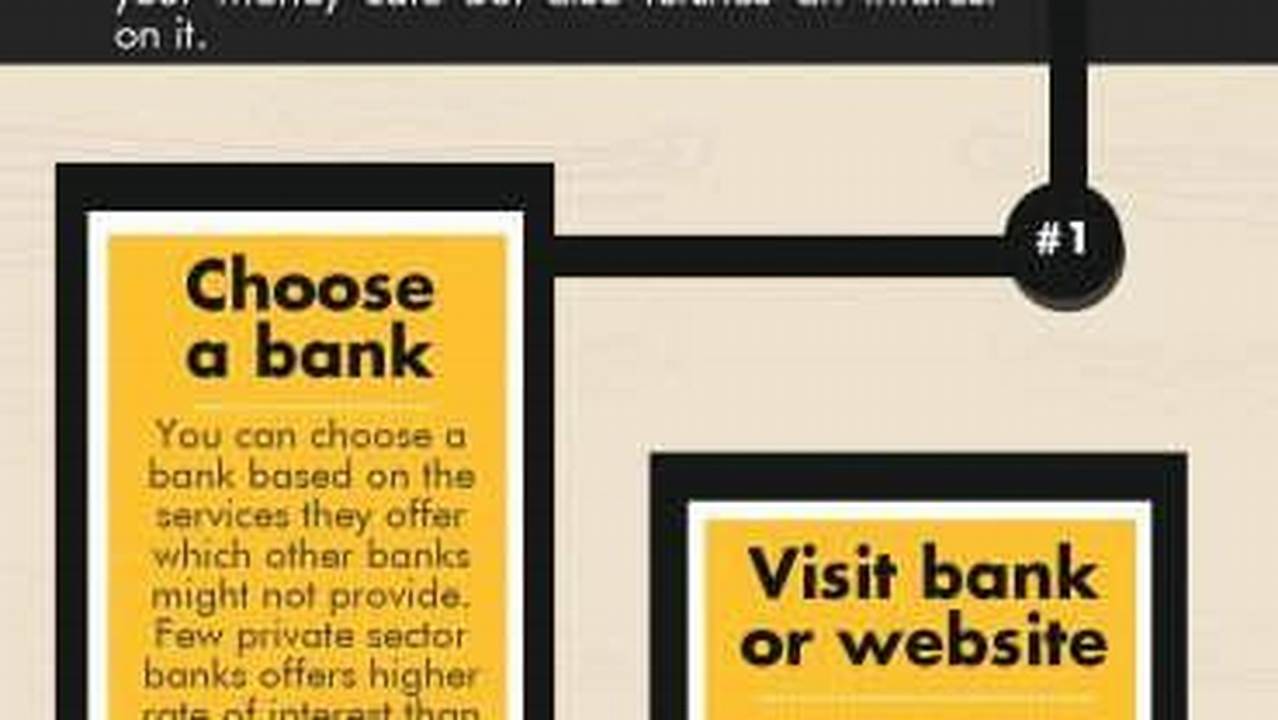

Research available options: Investigate institutions offering alternative identification methods.

Gather supporting documentation: Compile any available documentation, such as utility bills or community letters.

Contact local organizations: Seek assistance from community groups or financial inclusion advocates.

Understand the limitations: Be aware of potential account restrictions or limited functionality.

Frequently Asked Questions

Can I open a savings account without an ID?

The possibility depends on specific institutions and local regulations. Some may offer accounts with limited features using alternative verification methods.

What are the risks of banking without traditional ID?

Both the individual and the institution face potential risks related to security and fraud. Robust verification processes are crucial to mitigate these risks.

How can I find banks offering alternative ID options?

Research online or contact local community organizations specializing in financial inclusion for guidance.

What is the future of ID requirements in banking?

The trend is towards a more inclusive approach, leveraging technology and alternative verification methods while maintaining security and regulatory compliance.

What if I am a refugee or undocumented immigrant?

Some institutions and programs cater specifically to these groups. Research local resources and support organizations for guidance.

Are there any international initiatives supporting ID-less banking?

Yes, several international organizations and initiatives are working to expand financial inclusion and develop secure, accessible identification systems.

Expanding access to banking services is a complex challenge requiring careful consideration of security, regulation, and accessibility. While traditional identification methods remain important, exploring and implementing alternative solutions is crucial to ensuring financial inclusion for all.