Terminating a banking relationship can seem daunting, but with the right preparation and knowledge, the process can be straightforward and hassle-free. Understanding the necessary steps, required documentation, and potential implications ensures a smooth transition and avoids unwanted fees or complications. This guide offers a simplified approach to account closure, empowering individuals to navigate the procedure confidently.

Reason for Account Closure

Various factors can motivate individuals to discontinue their banking relationship. These may include relocating to a different financial institution offering better services or rates, consolidating accounts for simplified financial management, or simply no longer needing a particular account.

Gathering Necessary Documentation

Before initiating the closure process, it’s crucial to assemble all necessary documents. This typically includes a valid government-issued identification card, account statements, and any associated debit or credit cards linked to the account.

Contacting the Bank

Reaching out to the bank directly is essential. This allows individuals to confirm the specific requirements and procedures, ensuring a seamless closure. Scheduling an appointment can be beneficial, particularly for complex situations.

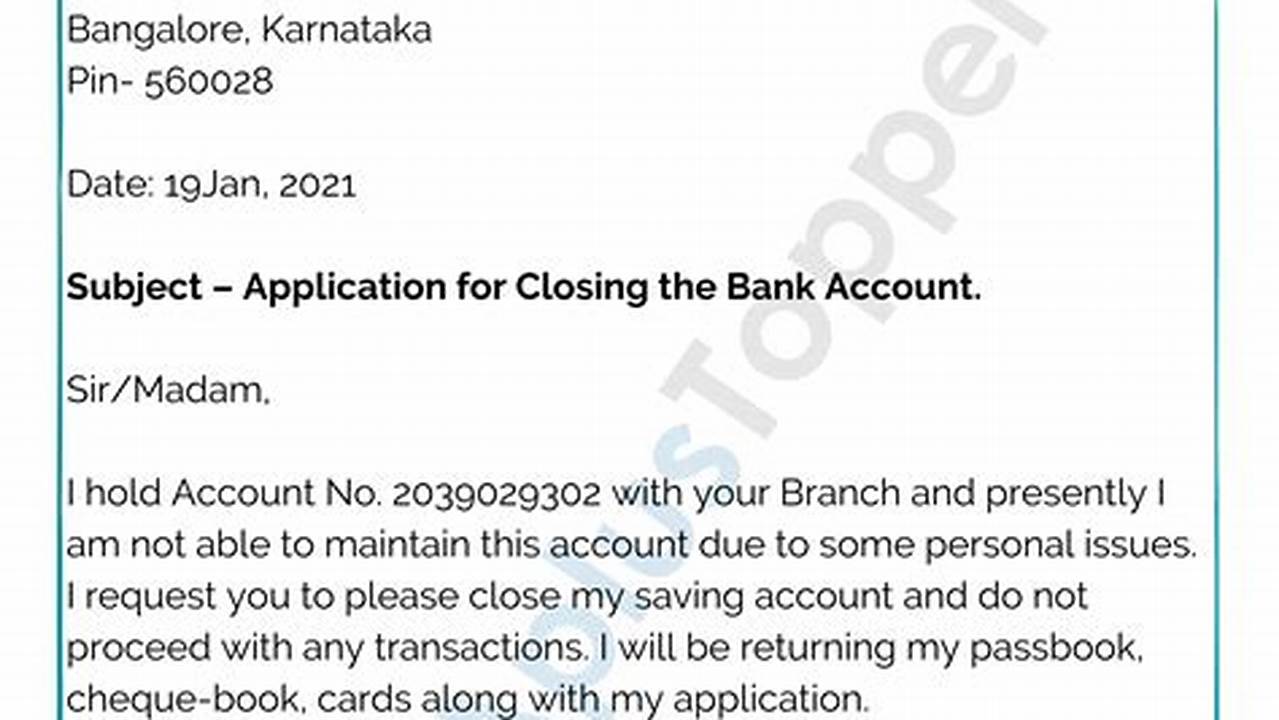

Completing Closure Forms

Banks typically require account holders to complete specific forms to formalize the closure request. These forms often request information such as the reason for closure, forwarding address for remaining funds, and confirmation of outstanding transactions.

Clearing Outstanding Transactions

Ensuring all pending transactions, including checks, automatic payments, and direct deposits, are processed before closing the account prevents complications and potential fees.

Transferring Remaining Funds

Account holders should decide on the preferred method for receiving their remaining balance. Options may include a cashier’s check, wire transfer, or transfer to another account.

Cancelling Automatic Payments and Direct Deposits

It’s crucial to inform any institutions or individuals who utilize the account for automatic payments or direct deposits about the closure. This prevents failed transactions and ensures a smooth transition.

Confirming Account Closure

After completing the necessary steps, it’s advisable to confirm the account closure with the bank. Obtaining written confirmation provides a record of the closure and protects against any future discrepancies.

Maintaining Records

Keeping records of the closure, including confirmation documents and final statements, is crucial for future reference and financial organization.

Tips for a Smooth Closure

Review recent account statements to identify any recurring transactions that need to be redirected.

Keep a small balance in the account until all outstanding transactions are cleared.

Request a written confirmation of account closure for your records.

Update your contact information with the bank to ensure smooth communication.

What happens to any remaining funds in the account?

Remaining funds can be transferred to another account, issued as a cashier’s check, or received via wire transfer, depending on the bank’s policies and the account holder’s preference.

How long does it take to close a bank account?

The timeframe for closing an account can vary depending on the bank and the complexity of the account. It can range from a few business days to a couple of weeks.

Are there any fees associated with closing a bank account?

Some banks may charge fees for closing an account, especially if it’s closed within a certain timeframe of opening. It’s essential to inquire about potential fees beforehand.

What if I have automatic payments linked to the account?

It is crucial to cancel all automatic payments and direct deposits associated with the account before closure to avoid failed transactions and potential fees. Notify the relevant parties of the account closure and provide them with updated payment information.

By following these steps and preparing accordingly, individuals can ensure a smooth and efficient account closure process, avoiding potential complications and maintaining their financial well-being.