Protecting your financial information is paramount in today’s digital landscape. Enhanced login security measures offer a robust defense against unauthorized access. This article details the implementation and benefits of a crucial security feature for Bank of America accounts: a two-step verification process.

Enhanced Account Security

This added layer of protection significantly reduces the risk of unauthorized access, even if a password is compromised.

Real-Time Fraud Prevention

Suspicious login attempts are immediately flagged, allowing for swift action to prevent fraudulent activity.

Peace of Mind

Knowing your account has this extra layer of security provides greater peace of mind regarding your financial information.

Simple Setup

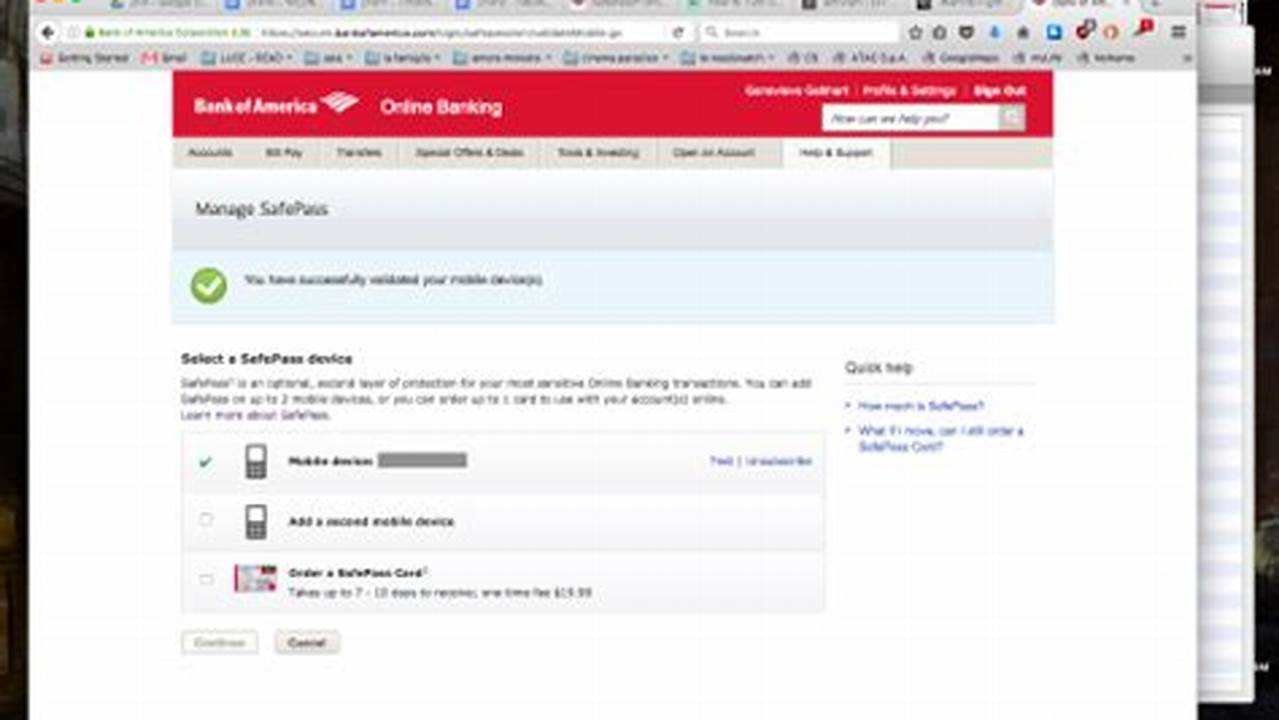

Enabling this security feature is a straightforward process, easily managed through online banking settings.

Multiple Verification Methods

Choose from various verification methods, such as text message or email, to suit your preferences.

Account Recovery Support

Established procedures are in place to assist with account recovery should access issues arise.

24/7 Monitoring

Continuous monitoring ensures the system remains effective and responsive to potential threats.

Protection Across Devices

Safeguard your account regardless of how you access it, whether through a computer, tablet, or smartphone.

Proactive Security Measures

Implementing this feature demonstrates a proactive approach to safeguarding financial well-being.

Staying Ahead of Threats

This security measure helps users stay ahead of evolving online threats and maintain control over their finances.

Tips for Maintaining Account Security

Regularly Update Contact Information: Ensure your phone number and email address associated with the account are current for seamless verification.

Be Wary of Suspicious Communications: Never share verification codes or login credentials in response to unsolicited emails or texts.

Use Strong Passwords: Create complex and unique passwords for all online accounts.

Monitor Account Activity: Regularly review account statements and transaction history for any unauthorized activity.

Frequently Asked Questions

What if I lose my phone or change my number?

The account recovery process provides options for regaining access, even if the primary verification method is unavailable.

Is there a cost associated with this security feature?

No, this security feature is provided at no additional cost to account holders.

Can I choose which verification method I use?

Yes, several verification methods are available, allowing users to select the most convenient option.

What if I don’t receive a verification code?

Troubleshooting steps are available to resolve issues with receiving verification codes.

How do I disable this feature if I no longer want to use it?

While not recommended, disabling the feature is possible through the online banking settings.

Prioritizing online security is essential for protecting financial assets. By implementing robust security measures like two-factor authentication, individuals can significantly enhance their account protection and maintain greater control over their financial well-being.